401k 2025 Max Contribution Limit Irs. The internal revenue service announced wednesday that the amount individuals can contribute to their 401(k) plans in 2025 has increased to $23,000, up from $22,500 for 2025. Each year, the irs places limits on the maximum amount participants can contribute to their 401(k) plans.

The 2025 401(k) contribution limit is $500 higher than this year’s $22,500 max, which reflected a major increase from the 2025 limit of $20,500. According to the report, mercer envisions the irs increasing contribution limits by $500 in 2025 for not only 401 (k)s, but also 403 (b) and eligible 457 plans.

What’s the Maximum 401k Contribution Limit in 2025? MintLife Blog, The irs has increased the contribution limits for most retirement accounts for tax year 2025. The 2025 401(k) contribution limit is $500 higher than this year’s $22,500 max, which reflected a major increase from the.

402k Contribution Limits 2025 Danny Orelle, For 2025, the 401(k) annual contribution limit is $23,000, up from $22,500 in 2025. The maximum limit for employer and employee.

The IRS just announced the 2025 401(k) and IRA contribution limits, 2025 total 401k contribution limit. The irs just released the 2025 contribution limits on qualified retirement plans, such as your 401 (k).

401(k) Contribution Limits in 2025 Meld Financial, The maximum limit for employer and employee. Starting in 2025, employees can contribute up to $23,000 into their 401(k), 403(b), most 457 plans or the thrift savings plan for federal employees, the irs announced nov.

Significant HSA Contribution Limit Increase for 2025, The contribution limit for a designated roth. The internal revenue service (irs) raised the annual contribution limits for 2025 to $23,000, which amounts to a cost of living adjustment and is an increase from $22,500 in.

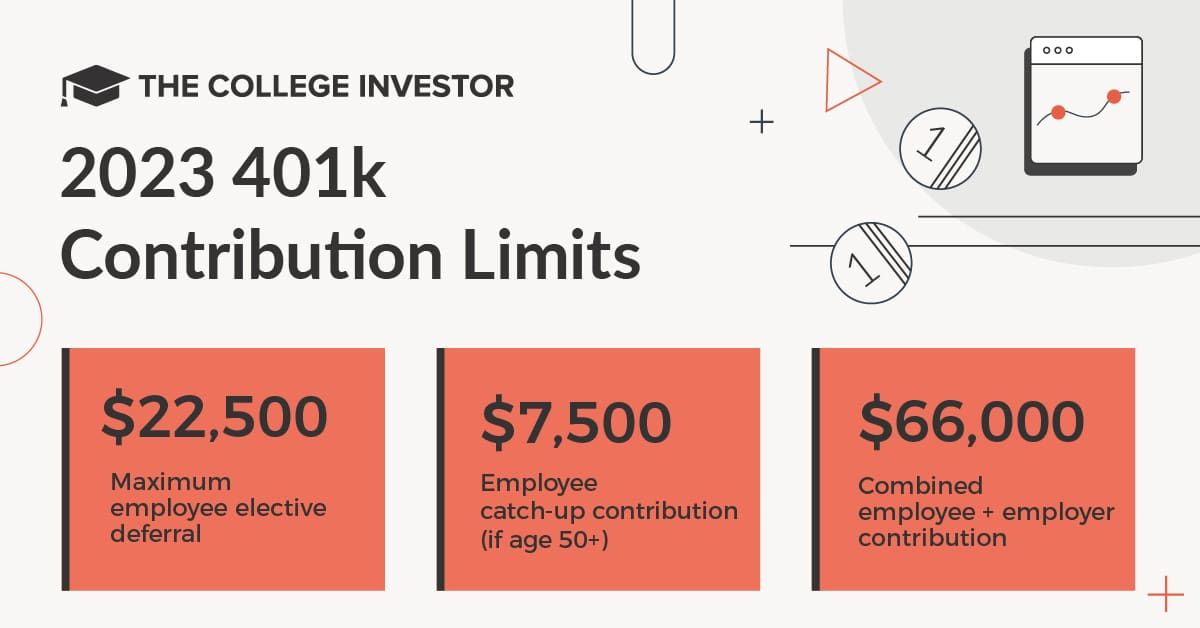

401k Contribution Limits 2025 Catch Up Over 50 Dacy Rosana, The contribution limit for a designated roth. The 401(k) contribution limit for 2025 is $23,000 for employee contributions, and $69,000 for the combined employee and employer contributions.

How The SECURE Act Changes Your Retirement Planning The Ugly Budget, The new $23,000 limit will. The maximum contribution for iras and roth iras increased to $6,500, up from.

401k Contribution Chart, 401(k), 403(b), most 457 plans, and thrift savings plan: The contribution limit for a designated roth.

What Is The Maximum Employer 401k Contribution For 2025, 2025 401(k) and 403(b) employee contribution limit. The 2025 401(k) contribution limit is $500 higher than this year’s $22,500 max, which reflected a major increase from the.

40 Passive Revenue Concepts For 2025 To Construct Actual Wealth, The 2025 401(k) contribution limit is $500 higher than this year’s $22,500 max, which reflected a major increase from the 2025 limit of $20,500. Irs max 401k contribution 2025.

The 401(k) contribution limit for 2025 is $23,000 for employee contributions, and $69,000 for the combined employee and employer contributions.